How Liferay Helps Fintech Improve Security and Customer Experience

Fintech companies face constant pressure to balance providing exceptional customer experiences with addressing growing security challenges. Data breaches, cyberattacks, and operational inefficiencies are real concerns that can impact both customer trust and regulatory compliance. While no solution can eliminate every risk, Liferay offers a powerful Digital Experience Platform (DXP) designed to help fintech companies mitigate these challenges to a great extent. Liferay provides a flexible, scalable foundation that allows businesses to create secure, personalized user journeys while adapting to evolving market needs.

At Aimprosoft Liferay portal development company, we’ve gathered valuable insights through years of developing Liferay-based solutions, and in this blog post, we’ll share how the platform’s features can improve both security and customer experience. With the expertise that we gained throughout 20 years of providing Liferay development services, we will guide you through Liferay’s potential and ways it can help with the enhancement of your customer portals or fine-tuning internal workflows.

Top 6 challenges with digital experiences in the fintech industry

The fintech industry is advancing rapidly, but with that progress comes a unique set of digital challenges. Without a unified DXP, companies often struggle to maintain the seamless, secure, and engaging user experiences their clients expect. Let’s examine in detail the key hurdles fintech companies face when they lack a robust DXP solution.

Digital challenges in fintech sector

1. Struggles with customer retention

In the highly competitive fintech environment, maintaining customer loyalty is a major challenge. Without a unified DXP, fintech companies often deliver fragmented user experiences, making it harder to engage and retain customers long-term. Customers expect seamless and personalized interactions, but when they encounter disjointed services or a lack of cohesion across platforms, they’re more likely to switch to competitors who offer higher quality of the provided services.

In fact, 12% of banking leaders reported losing 30%-40% of their customers for failing to adopt a customer-centric approach within their operations. As a result, without a unified platform, meeting clients’ expectations becomes nearly impossible, leading to increased churn.

2. Inefficient data management and personalization

Fintech companies collect vast amounts of user data, but without a unified DXP, usage of that data to deliver personalized services is often inefficient. Customers expect personalized offers, tailored financial advice, and relevant product suggestions, none of which are possible without an integrated platform.

According to a report from The Financial Brand, 33% of customers abandon a business relationship due to a lack of personalization. Additionally, 72% of customers stated that personalization is highly important to them, and 77% of banking leaders agreed that personalization leads to increased customer retention. This shows that without the ability to offer hyper-personalized services, fintech companies risk losing a significant portion of their customer base, as clients expect tailored interactions and real-time, relevant product recommendations.

3. Security risks

Fintech companies handle sensitive financial information and are prime targets for cyberattacks. Without a DXP that integrates advanced security measures across all platforms, managing security becomes fragmented, increasing the risk of data breaches and regulatory non-compliance.

Malware is known to be one of the most common types of attacks, targeting about 40% of financial companies worldwide. Moreover, 79% of financial institutions and 77% of investment firms cite cyberattack vulnerability as a primary concern that impacts their digital transformation plans. This highlights the urgent need for robust security protocols to mitigate these risks and ensure seamless, secure operations.

4. Slow delivery of new features

In a competitive market like fintech, the ability to rapidly release new features is critical. However, when platforms are scattered and unconnected, launching new services or updates becomes a lengthy and complicated process, often leading to missed opportunities.

In fact, a report shows that 20% of banking clients are lost due to slow digital transformation in banking and the inability to meet evolving customer expectations. The longer the delay in innovation, the greater the risk of losing valuable customers due to poor digital banking customer experience

5. Integration limitations

Fintech companies are often running on a complex mix of legacy systems, connected systems, and third-party APIs. Without a unified DXP, achieving seamless integration across these systems becomes increasingly difficult. Legacy systems, while critical to business operations, often lack modern API support and struggle to keep up with the real-time demands of today’s fintech services. This results in fragmented data flows, making it hard to provide consistent digital customer experiences and real-time updates.

Moreover, third-party services such as payment gateways, KYC/AML platforms, and regulatory services often come with their own API limitations. Without a unified platform to mediate and standardize these integrations, fintech companies face increased latency, higher maintenance costs, and constant pressure to ensure systems communicate effectively.

The lack of connectivity between these fragmented systems hinders the ability to deliver a cohesive digital banking user experience. Compatibility issues with older systems and manual data synchronization only amplify the operational inefficiencies, slowing down innovation and limiting scalability.

6. Scalability, performance, and growth

As fintech companies grow, their digital platforms must scale quickly to accommodate increasing user demands. Without a unified DXP, managing performance across multiple systems becomes a significant hurdle. This fragmentation results in slower response times, system crashes during peak usage, and an inability to handle the surge in concurrent users.

The complexity intensifies when fintech companies need to introduce new features or expand services to meet growing market demands. Without a centralized platform, each system operates in isolation, making it challenging to scale horizontally or vertically. This impacts not only operational efficiency but also hinders business growth.

A robust DXP like Liferay offers fintech companies the infrastructure needed to support rapid growth, ensuring that performance remains optimized even during peak traffic or as new services are deployed. By unifying the digital experience, companies can reduce the friction of scaling and support their growth trajectory with confidence.

Ready to tackle your biggest fintech challenges? Explore a detailed breakdown of Liferay DXP’s features and discover how they can elevate your security, scalability, and customer experience.

These challenges highlight the need for a unified DXP like Liferay. In the next section, we’ll explore how Liferay’s features can help fintech companies overcome these obstacles and thrive in the competitive market.

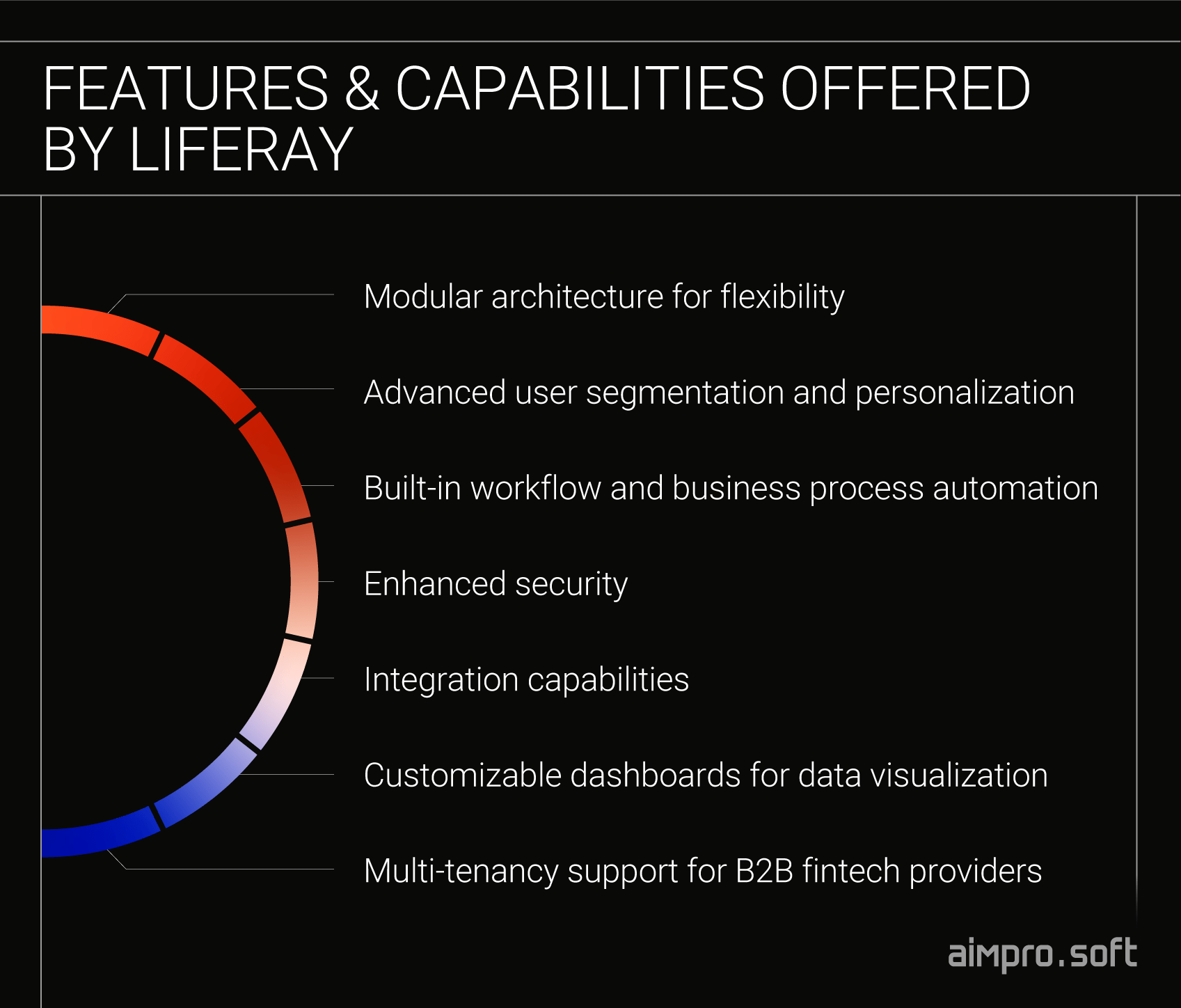

How Liferay helps overcome digital experience challenges

Liferay brings fintech companies the best of both worlds: powerful technical tools and meaningful business advantages. Let’s explore some specific features that can help deliver secure, seamless, and engaging digital experiences.

Liferay benefits for fintech sector

1. Liferay’s modular architecture for flexibility

A key feature of Liferay technology is its modular architecture, which is designed to offer flexibility and adaptability in a fast-paced fintech environment. As businesses grow and customer needs evolve, the ability to scale, integrate, and modify systems without disrupting existing infrastructure becomes crucial. Liferay’s modularity can help your business respond quickly to changes, maintaining agility in both development and operations.

On top of that, since Liferay is a Java-based low-code platform, its low-code and no-code tools significantly enhance development speed. Our Lead Liferay Architect, Vitaliy Koshelenko notes that Liferay’s low-code and no-code capabilities can help companies build and deploy solutions faster while reducing development time by up to 600%.

Tech benefit: Liferay’s modular architecture, combined with its no-code capabilities, allows adding or removing functionalities without affecting the entire system. Microservices architecture enables seamless development and integration, offering the ability to scale and modify systems in an agile and efficient manner.

Business advantage: This flexibility enables you to introduce new products or services faster, adapt to market changes, and avoid costly system overhauls.

2. Advanced user segmentation and personalization

Liferay’s advanced user segmentation and personalization features allow providing tailored experiences that meet the diverse needs of your users. As customer expectations for personalization continue to grow, fintech firms require the ability to deliver dynamic, relevant content that resonates with users. Liferay digital experience platform enables you to use data-driven insights, ensuring that each customer receives a unique, engaging experience that builds trust and drives loyalty.

Tech benefit: Liferay’s advanced segmentation capabilities help segment users based on their behavior, preferences, or financial profiles. The dynamic content display ensures that the right information is served to the right customer, boosting engagement.

Business advantage: By providing highly personalized user journeys, you can increase customer satisfaction, loyalty, and conversion rates.

3. Built-in workflow and business process automation

Liferay’s built-in workflow and business process automation capabilities play a key role in streamlining operations. By automating repetitive tasks such as customer onboarding and compliance checks, Liferay empowers you to reduce manual errors and streamline processes.

Tech benefit: The platform can be integrated with external systems to streamline complex operations across the fintech ecosystem.

Business advantage: Automating repetitive tasks can help you speed up business processes, reduce manual errors, and improve operational efficiency. This, in turn, can lead to faster turnaround times for customer requests, giving your company a competitive edge.

4. Enhanced security

Liferay’s enhanced security features, including role-based access control (RBAC), provide you with the tools to manage permissions and ensure that only authorized personnel have access to critical information.

Tech benefit: Beyond just role-based access control, Liferay offers advanced auditing and encryption features that allow monitoring access in real time and ensure data protection across all touchpoints. Its flexible security model also supports the integration of external security tools, providing an extra layer of defense against cyber threats.

Business advantage: With better control over data access, you can reduce the risk of security threats and meet stringent regulatory compliance requirements. This enhances trust with customers, protecting the company’s reputation.

5. Integration capabilities

Fintech companies require seamless integration with a wide range of external and internal services. Liferay’s API integration layer is designed to meet these needs, offering fintech firms the flexibility to connect with both third-party services and internal systems, ensuring consistent data flow across the organization. This robust integration capability reduces operational complexity and allows for smoother, more efficient business processes.

Tech benefit: Liferay’s robust API integration layer allows fintech companies to easily connect with external services like payment gateways, KYC/AML providers, and other third-party financial services. Its RESTful and GraphQL APIs provide flexibility in how fintech companies integrate these external and internal systems.

Business advantage: Seamless integrations reduce operational silos and improve internal workflows by ensuring that all systems, from customer-facing portals to backend systems, can work together efficiently. This improves operational efficiency, reduces errors caused by data fragmentation, and enables fintech firms to respond more quickly to market demands and regulatory changes.

6. Customizable dashboards for data visualization

Liferay’s customizable dashboards provide the ability to visualize key data such as user behavior, financial performance, and system health in real time. This capability allows tracking trends and potential risks easily, helping remain proactive in identifying growth opportunities and addressing challenges. By using data visualization, you can optimize operations and drive informed, strategic decision-making.

Tech benefit: In addition to real-time visualization, Liferay’s dashboards support custom data integration, allowing fintech firms to consolidate multiple data sources into a single, coherent view. This not only enhances decision-making but also enables advanced analytics, improving the ability to predict trends and mitigate risks before they escalate.

Business advantage: Fintech firms can make informed, data-driven decisions faster, identifying new trends, potential risks, and areas for growth. This level of insight helps businesses remain proactive rather than reactive, fostering growth and stability.

7. Multi-tenancy support for B2B fintech providers

Managing multiple clients or business units on a single platform can be complex, but Liferay’s multi-tenancy feature simplifies this process for B2B fintech providers. This capability allows companies to isolate customer portals while sharing the same infrastructure. Each tenant can have its own unique content, users, and security settings, offering flexibility without the need for separate systems. For fintech firms, this translates into cost-efficiency and scalability, making it easier to manage multiple clients while delivering tailored, secure experiences.

Tech benefit: Apart from isolated Liferay portals and users, the multi-tenancy feature ensures streamlined management with centralized control, allowing fintech firms to scale operations efficiently. It also supports the customization of security policies and workflows per tenant, ensuring compliance and tailored solutions for each client while reducing administrative overhead.

Business advantage: For fintech firms that serve multiple B2B clients or divisions, multi-tenancy offers cost-efficiency by reducing the need for duplicate systems. It simplifies the management of different clients while offering tailored experiences, allowing fintech companies to scale their operations effectively.

Contact us today to get a custom plan that will give you answers on how to make the most out of Liferay for your business.

CONTACT USWith Liferay’s specific features, you can gain the tools to overcome the challenges of fragmented systems, improve operational efficiency, and deliver personalized, secure customer experiences. In the next section, we’ll explore real-world examples of Liferay in action, including Aimprosoft’s case study, through which we will show how we help our client automate business processes, improve employee performance, and streamline user experience as part of their digital banking transformation.

Liferay real-world use cases: how Liferay can improve fintech operations

Liferay’s real impact is best demonstrated through its transformative applications in the fintech industry. From optimizing content management to streamlining customer interactions and boosting operational efficiency, Liferay equips fintech companies with the tools they need to overcome challenges like scalability, integration, poor customer experience in digital banking, and customer retention. By leveraging Liferay’s platform, businesses can enhance their digital presence while maintaining security and delivering superior customer experiences.

Case #1: GAIN Credit

The story: Gain Credit, a global fintech company serving their customers their alternative credit brands, namely, Drafty and Lending Stream, needed a more efficient content management system. Their existing platform required Liferay experts to make content changes, slowing down operations and reducing flexibility. To stay competitive and improve customer satisfaction, they needed a customer engagement platform for fintech that would streamline updates and optimize performance.

Challenges:

- Long turnaround times for content updates.

- Lack of content publication tracking.

- Poor SEO and low Lighthouse performance scores, which negatively impacted their digital visibility.

Solution: To address these challenges, Gain Credit sought a solution that could also serve as a digital banking engagement platform, one that would improve their content management processes while enhancing the overall customer experience platform for fintech. By adopting Liferay, they aimed to reduce inefficiencies, increase flexibility, and ensure their platform could scale with the demands of their growing customer base.

Results and key metrics:

- 80% productivity boost: Content updates reduced from a week to one day.

- 31-point Lighthouse score increase: Improved website performance and SEO.

- Improved SEO ranking: Thanks to headless API integration and enhanced page speed.

How Aimprosoft transforms the financial experiences with Liferay

Case #1: Intranet for internal banking operations

The story: The client used software to automate the internal operations of their digital banking platform. However, the system was outdated and couldn’t save as much time as expected. The company saw system migration to Liferay as the best solution, but they didn’t have enough expertise to do that in-house. The company contacted Aimprosoft Liferay consulting company with a clear description of what needed to be done during Liferay portal development, including mockups and workflows. While working on the project, our Liferay developers implemented the following:

- Multiple custom forms that are filled and submitted by bank operators;

- Integrated and adjusted workflows within an omnichannel digital banking platform through which the submitted requests are passed through and finally approved or rejected by the head of the bank;

- Integration of an external API for data synchronization;

- Implementation of search functionality and dashboard UI.

Project outcomes:

- A newly-migrated system reduced the time spent on daily operations and automated business processes within a bank.

- Thanks to Liferay’s built-in workflow system, numerous workflows for smooth processing and approval of bank operator requests were implemented quickly.

- Using profound expertise in Liferay, we filled the existing knowledge gap and delivered a user-friendly system, mitigating risks related to migration.

Tech stack: Liferay, Java, Elasticsearch, Headless API

Conclusion

As you can see, Liferay DXP offers the perfect blend of security, scalability, and personalization, helping you overcome key industry challenges such as customer retention, integration limitations, and performance bottlenecks. Its powerful features help businesses create seamless, secure digital experiences that meet both customer expectations and regulatory demands.

At Aimprosoft Liferay services company, we specialize in delivering tailored Liferay solutions for the fintech industry. Whether you need help with DXP adoption, upgrading outdated systems, integrating Liferay CMS functionality, or enhancing your platform’s performance, our expertise ensures you get a solution aligned with your business goals. Contact us today and hire Liferay development company to help your fintech company use Liferay to drive growth and operational excellence.

FAQ

How can Liferay help improve the security of our fintech platform?

Liferay DXP is designed with robust security features that safeguard sensitive financial data. With built-in encryption, role-based access control, and secure API integrations, Liferay ensures that customer and transactional data are protected at every touchpoint. At Aimprosoft, you can get both Liferay consulting services and development assistance with configuring these security measures to fit your fintech company’s unique needs, helping you meet regulatory requirements while maintaining high standards of protection.

Can Liferay easily integrate with our existing legacy systems and third-party services?

One of Liferay’s strengths is its ability to integrate with both legacy systems and modern third-party services. Liferay’s API-first architecture allows for seamless connections to external platforms, whether it’s a core banking system or a regulatory API. At Aimprosoft, we ensure that these integrations are smooth and secure, allowing your existing systems to communicate effortlessly with new digital platforms.

How quickly can we see improvements in customer experience after implementing Liferay?

The timeline for seeing improvements can vary based on the scope of implementation, but many fintech companies experience immediate enhancements in user experience thanks to Liferay’s personalization features and unified platform. At Aimprosoft, we ensure your customers can benefit from a smoother, more personalized digital banking experience as quickly as possible.

How scalable is Liferay for growing fintech companies?

Liferay is built for scalability, allowing fintech companies to grow without the headaches of system limitations. Whether you’re expanding your customer base, upgrading legacy digital banking solutions, adding new financial products, or entering new markets, Liferay’s modular architecture and cloud capabilities ensure that your platform can scale effortlessly. Aimprosoft works closely with fintech clients to create scalable solutions that support your long-term growth while keeping performance optimized.